by JAY WILDER – October 31, 2018

Most of the conversation about the Trump Tax Cuts (aka Tax Cuts and Jobs Act) has been about who benefits most. But an equally important factor is what kind of an impact it will have on the deficit. Are key conservative media outlets and decision-makers still repeating the mantra that tax cuts fully pay for themselves, and so do not contribute to the deficit? What I’m finding is that their position has become more nuanced – that tax cuts partially pay for themselves, but require additional actions (cutting regulations and reducing spending) to completely fill the budget gap they cause.

What the Studies Say

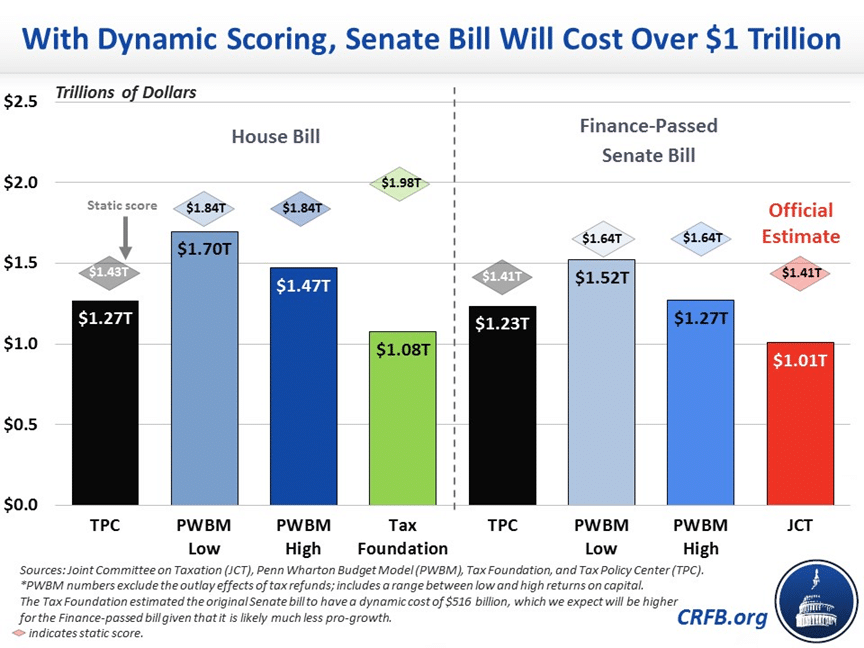

The Committee for a Responsible Federal Budget aggregated several studies from when the House and Senate each had their own version of the tax bill.

This includes estimates from the left-leaning Tax Policy Center, the right-leaning Tax Foundation, and the nonpartisan Penn Wharton Budget Model and Joint Committee on Taxation (who provided the official estimate to Congress). The “static score,” which are the scores in the diamond shapes, are solely the direct effects of the tax law – if your taxes go down by $100, that’s a $100 cost to the government, so the static score is $100. Dynamic scoring is more realistic but also more difficult to get a consensus estimate, because it tries to estimate indirect effects – with lower taxes, you may decide to work more hours, and pay taxes on those additional wages. You may take that $100 and spend it on goods, which increases a company’s profits, which get taxed. And they may hire more workers, who pay taxes on their salaries. So it’s not surprising that there are a wide range of estimates for the dynamic scoring of the tax plan. But the important point is that every one of them determined that the tax plan does not fully pay for itself. The official JCT score estimates that 28% of the static cost is returned as revenues to the government due to higher growth; the other studies give a range from 7% to 45%.

What Conservative-Leaning Media Outlets Say

Here’s what Robert Verbruggen wrote in the National Review (Nov 9, 2017):

“Republicans should stop pretending that they won’t be making the debt significantly worse if they continue down this path. If they think it’s a good trade to hike the debt in exchange for (hopefully) boosting the economy, they should make their case openly.”

“As an instinctive deficit hawk, my preferred approach would be to pass a tax-reform bill that’s revenue-neutral on its face or at least close to it — and then use any resulting growth to reduce the debt. This means rate cuts must be paid for by eliminating deductions and carve-outs or by (gasp) reducing spending.”

James C. Capretta writes in the American Enterprise Institute (Dec 8, 2017):

“…no credible model of tax policy and the U.S. economy today projects major tax rate cuts will pay for themselves. That particular GOP talking point — so often used by Republicans this year and in the past — is counterproductive and should have been retired some time ago.”

Forbes published an article (Dec 10, 2017) from Jeffrey Dorfman, “The Tax Cuts Will Pay For Themselves If We Wait Long Enough”.

Despite the title, this article is mostly just making the mathematical point that “If tax reform results in higher GDP growth of 0.3% per year, that growth will pay for the tax cuts in about 26 years.”

What Key Republican Leaders Say

Let’s take a look at the four key players who helped pass the tax law, and what their public statements have been, both before and (where possible) after the law was passed.

Steve Mnuchin, Secretary of the Treasury.

Washington Ideas Conference, 9/28/2017 (pre-tax cut)

“Not only will this tax plan pay for itself, it will pay down debt.”

Note that at this point, Trump’s plan was very different than what would become  law. For one thing, it was much larger ($2.2T vs $1.5T), and included reducing the number of tax brackets to three; the final law kept seven brackets. But still a clear message that this tax cut will pay for itself.

law. For one thing, it was much larger ($2.2T vs $1.5T), and included reducing the number of tax brackets to three; the final law kept seven brackets. But still a clear message that this tax cut will pay for itself.

CNN State of the Union, 11/12/2017

“In our models, we believe there will be $2.5 trillion of growth… If we increase GDP by 30 or 40 basis points, this plan is break-even.”

At this point, the House and Senate plans were pretty close to their final state. And Mnuchin’s still feeling confident – $2.5 trillion in growth (meaning growth of tax revenue received by the government) minus the $1.5 trillion tax cut would mean a $1 trillion surplus as a result of the tax cuts. His second sentence lowers the bar a bit to discuss what would be needed to be break-even; 30 or 40 basis points of increased GDP. A “basis point” is a common financial shorthand for 0.01%, so what he’s saying that if GDP growth increased by 0.30% or 0.40% as a result of this law, it would pay for itself. For example, if GDP growth was projected at 2% without this law, and the law caused GDP growth of 2.4%, then the law pays for itself.

On 12/11/2017, under pressure to justify his zero-cost statements, Mnuchin’s Department of the Treasury put out a one-page report which specified that the $1.5 trillion shortfall in revenues would be more than made up for by $1.8 trillion in additional revenue due to effects of the tax cuts “as well as from a combination of regulatory reform, infrastructure development, and welfare reform as proposed in the Administration’s Fiscal Year 2018 budget.”

So now we’re seeing Mnuchin back off – first of all, he’s now talking about $1.8 trillion in growth instead of $2.5 trillion. And achieving that figure requires not just tax cuts, but also several other policies not related to tax cuts. So, he’s not going to come out and say it explicitly, but he’s indirectly saying that tax cuts won’t pay for themselves.

He was a guest at the Economic Club of Washington on 1/12/2018 (after the law was passed), and had this exchange with the moderator:

RUBENSTEIN: So the tax bill, it is said by some that it will increase the U.S. debt by roughly $1.1 to $1.5 trillion over 10 years. Do you agree with that?

SEC. MNUCHIN: I don’t.

RUBENSTEIN: You think it will be revenue neutral, or?

SEC. MNUCHIN: So I mean, here are the numbers, OK? The joint – let’s start with Joint Tax, which scored it at…$1.5 trillion, OK? That was what we had to reconcile to on what we call a static basis with no change. Joint Tax thought there was about $500 billion of what we call dynamic scoring, in revenue that we’d get back. There was also about another $450 or $500 billion in what we call the difference between policy and the baseline. So, they were measuring it to what they called the baseline. There were tax extenders that were rolled over every year. Again, our view is you should measure it to what the actual policy is. And, you know, we think there will be over a trillion dollars of growth. So, I do think this will pay for itself.

So, he’s referencing the Joint Committee for Taxation, who had a static score of about $1.5 trillion and a dynamic score of $1 trillion. But this is still not a great story for Mnuchin to tell – he has said in the past that tax cuts pay for themselves, and his boss certainly doesn’t want him admitting to a $1 trillion increase in deficits. So how does he get from $1 trillion to $0? He doesn’t, really. He starts by saying that there is an additional $500B in the difference between the “policy” and the baseline that the JCT was using, and then reiterates that he thinks there will be over a trillion dollars of growth (even though he needs $1.5 trillion). Again, similar to his last statement, he is hinting that there are policies other than the tax cuts which will be needed to make this revenue-neutral.

Paul Ryan, Speaker of the House

On Dec 1st (before the law was passed), Ryan told NPR:

“Actually I don’t think it will increase the deficit… I think this will give us the kind of economic growth we need to keep jobs, to keep companies here, and faster economic growth.”

Ryan is saying “I don’t think it will”, as if it’s just his opinion, not as an expert. He’s not making a definitive statement.

Then on Dec 20th, as soon as the tax cut became law, he went on NBC and had this exchange:

Savannah Guthrie: “Are you saying that the growth you’re going to get from this tax cut will equal the amount it would cost on the deficit side so that it’s a wash, so that you’re not adding to the deficit at all?”

Ryan: “Nobody knows the answer to that question, because that’s in the future. But what we do know is that this will increase economic growth.”

So, this time he altogether avoided the question about tax cuts paying for themselves. Also, note that his second sentence contradicts the first – if nobody can answer questions about the future, then why can we predict increased economic growth in the future?

Mitch McConnell, Senate Majority Leader

At a press conference in Louisville on 12/2/2017 (before the cuts were passed), McConnell said:

“To fill that ($1.5 trillion) gap over the next ten years, the economy would only have to grow by four-tenths of one percent… I not only don’t think it will increase the deficit, I think it will be beyond revenue-neutral. In other words, I think it will produce more than enough to fill that gap.”

Stronger than Ryan’s statement, although he’s still saying that he thinks it will produce enough growth.

McConnell, after the tax cuts were passed: ![]()

![]()

Mick Mulvaney, White House Budget Director (and famous deficit hawk for the Tea Party)

Pre-tax cuts:

On Oct 1st, when interviewed by Chris Wallace on Fox News (and by the way, if anybody from Fox News is reading this, please fix the shitty search functionality on your website – I search “Wallace Mulvaney” and get no results??), he had the following exchange:

Wallace: “The Senate Republican Budget Plan calls for a tax cut that is going to cost the Treasury $1.5 trillion… Back when you were in Congress, you were a deficit hawk. What happened, sir?”

Mulvaney: “We need to have new deficits. We need to have the growth. If we simply look at this as being deficit-neutral, you’re never going to get the type of tax reform and tax that you’re going to need, to sustain 3% economic growth.”

Sounds like a refreshingly honest admission that the tax cuts will not pay for themselves. But then later on in the interview, he muddies the waters:

Mulvaney: “Growth works. What we’re doing in the administration to spur growth in terms of regulatory reform work. And what we’re working on right now is to make sure that those tax cuts add to that. We do believe that sustained 3% economic growth is possible, and that that is the way you can balance the budget long-term.”

This is kind of a masterpiece. It’s an absolutely reasonable statement. But keep in mind that the original question was about whether the tax cut was going to cost the Treasury $1.5 trillion. Mulvaney is answering a much different and broader question, which is “Can you balance the budget long-term?” That brings in two other policies that have nothing to do with the tax cuts: regulatory reform (which he mentions) and spending cuts (which he doesn’t, but that’s half of the equation when talking about a balanced budget). Again, nothing wrong with that, it’s a reasonable statement that can be argued in either direction. But it’s fair to infer that he’s saying that the tax cuts alone do not pay for themselves; it takes all three components working together to balance the budget.

Mulvaney, after the tax cuts passed: ![]()

![]()

Conclusion

There’s a pretty clear pattern here – most Republicans seem to be backing off the notion that the Trump Tax Cuts will fully pay for themselves. This means that there may be an opportunity for a bipartisan analysis of the tax cuts’ impact on the deficit, separate from any spending decisions.